Building wealth through real estate has long been recognized as a reliable strategy. One of the key metrics for assessing the success of real estate investments is equity growth. But how exactly can you understand and track this growth? A handy tool for this is the rental property balance sheet example. By using this straightforward financial document, landlords and investors can gain deeper insights into their property’s financial performance and ensure long-term growth.

This guide will walk you through the concept of equity growth in real estate and explain how a rental property balance sheet can serve as a practical example to understand it better.

What Is Equity Growth in Real Estate?

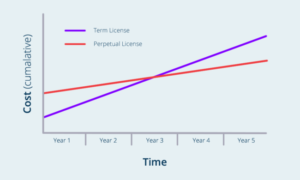

Equity growth is the increase in the value of your investment stake in a rental property over time. It occurs through two primary mechanisms:

- Property appreciation – as market values rise, the worth of your property increases.

- Mortgage principal reduction – as you pay down your mortgage, your ownership stake grows.

Equity growth signifies the true financial benefit of owning rental property. Tracking your growth helps you evaluate performance, make informed decisions, and identify opportunities to reinvest.

The Role of the Rental Property Balance Sheet

A rental property balance sheet is a snapshot of your investment’s financial health at any given moment. It captures all your property’s assets, liabilities, and equity, allowing you to see how each component contributes to equity growth. By understanding and managing this report, you can better analyze progress and strategize for the future.

Key Components of a Rental Property Balance Sheet

- Assets

Include everything the property is worth. This includes:

– Current market value of the property

– Cash reserves

– Any other tangible or financial extras associated with the property

- Liabilities

Represent obligations or debts tied to the investment:

– Mortgage balance

– Property taxes owed

– Maintenance expenses that are yet to be paid

- Equity

Equity is what remains when the liabilities are subtracted from the assets. It reflects your ownership stake, which serves as an indicator of how much financial cushion your property offers.

Using these three core components in a simple formula, you can calculate your equity as:

Equity = Assets – Liabilities

Benefits of Tracking Equity Growth with a Rental Property Balance Sheet

- Clear Financial Insight

The balance sheet provides a concise summary of your rental property’s financial standing. By regularly updating this document, you can clearly see how your property’s value, debts, and equity evolve over time. This transparency ensures that you have an accurate idea of your financial progress.

- Better Decision-Making

Understanding your property’s equity helps you make more informed investment decisions. Whether you’re considering refinancing, selling, or reinvesting in another property, knowing your current equity allows you to evaluate your options effectively.

For example, if you see significant equity growth in your rental property, you might choose to tap into that equity by taking a cash-out refinance to fund another real estate purchase.

- Tracking Return on Investment (ROI)

By tying your equity growth figures with rental income and other financial factors, you can measure your property’s ROI. This assessment helps you determine if the property is performing well relative to your initial investment and other possible opportunities.

- Planning for Long-Term Wealth

A balance sheet simplifies the complexity of property metrics, making it easier to plan for long-term growth. Whether it’s preparing for retirement or generating legacy wealth, a well-maintained balance sheet helps you stay aligned with your goals.