The year 2026 is shaping up to be a pivotal year for Medicare Advantage plans. With evolving healthcare trends, expanded benefits, and emerging policy changes, these plans are becoming increasingly attractive to seniors seeking comprehensive coverage. However, selecting the right plan requires careful consideration of benefits, costs, and provider options. This article will guide you through what to expect in Medicare Advantage plans 2026, how to compare plans effectively, and how to enroll with confidence.

What Are Medicare Advantage Plans?

Medicare Advantage, also known as Part C, is an alternative to Original Medicare provided by private insurance companies approved by Medicare. These plans often bundle hospital (Part A), medical (Part B), and prescription drug coverage (Part D), along with additional benefits like dental, vision, hearing, and wellness programs.

The primary appeal of Medicare Advantage lies in its comprehensive coverage and cost predictability. However, variations in benefits and out-of-pocket expenses between plans mean that understanding your options is crucial.

What’s New for Medicare Advantage Plans in 2026?

Enhanced Benefits and Coverage

Medicare Advantage plans in 2026 are expected to offer even more robust benefits. Many providers are focusing on addressing social determinants of health. For instance, plans may include expanded transportation services, meal delivery, and even fitness programs tailored to seniors’ needs.

Additionally, telehealth continues to be a prominent feature, with more plans integrating virtual care options into their offerings. For beneficiaries in rural areas, this can significantly improve access to quality healthcare.

Flexibility in Plan Options

The flexibility of these plans is set to increase, giving beneficiaries more tailored options to meet specific needs. For example, some plans might focus on chronic condition management, offering personalized care plans for individuals with conditions like diabetes or heart disease.

Cost Adjustments

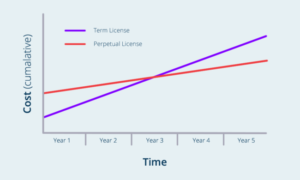

While premiums are projected to remain stable for most enrollees, out-of-pocket maximums might see slight adjustments. It’s essential to review these changes annually to ensure your plan aligns with your budget.

How to Compare Medicare Advantage Plans

When evaluating Medicare Advantage plans, it’s essential to keep the following factors in mind:

1. Coverage Options

Check which services are covered beyond standard Medicare benefits. Consider plans that include extras like dental care, hearing aids, or wellness programs, depending on your lifestyle and health needs.

2. Provider Networks

Medicare Advantage plans typically operate within a network of healthcare providers. Assess whether your preferred doctors, specialists, and hospitals are in-network. Out-of-network care can sometimes lead to higher costs.

3. Out-of-Pocket Costs

Look at premiums, copayments, deductibles, and out-of-pocket maximums. Balancing lower monthly costs with potential out-of-pocket expenses for frequent care is vital.

4. Prescription Drug Coverage

Ensure the medications you require are included in the plan’s formulary. Check tiers, as prescription costs can vary depending on where your medication falls in the pricing structure.

5. Plan Ratings

Medicare issues star ratings for Medicare Advantage plans, scoring them on a five-star scale based on customer satisfaction, quality of care, and other factors. A high-rated plan may indicate better service and reliability.

How to Enroll in a Medicare Advantage Plan for 2026

Step 1: Understand Enrollment Periods

You can join, switch, or drop a Medicare Advantage plan during specific windows:

- Initial Enrollment Period (IEP): When you first become eligible for Medicare.

- Annual Enrollment Period (AEP): October 15 through December 7 each year.

- Open Enrollment Period (OEP): January 1 through March 31 for plan changes.

Step 2: Compare Plans

Use Medicare’s Plan Finder tool or discuss your options with a licensed agent to identify plans that fit your needs.

Step 3: Contact the Plan

Once you’ve chosen a plan, contact the provider to complete your enrollment. Be prepared with your Medicare card and any relevant personal information.

Step 4: Review Your Coverage

After enrolling, review your plan materials carefully to ensure everything aligns with your expectations. Keep an eye out for your member ID card and welcome packet.

Secure Your Future with the Right Plan

Medicare Advantage plans in 2026 promise better benefits, flexibility, and innovative solutions to meet diverse healthcare needs. By staying informed and carefully comparing your options, you can select a plan that not only suits your budget but also enhances your quality of life. Start exploring your options today and take the steps necessary to secure a healthier tomorrow.