Cashing out small payment amounts can sometimes feel like more effort than it’s worth, particularly when financial platforms or services tack on fees or impose withdrawal limits. However, the increasing prevalence of side gigs, microtransactions, and flexible payment apps has made this topic increasingly relevant. Whether you’re a freelancer awaiting micropayments or someone managing small e-commerce transactions, knowing the most efficient methods to access your funds is essential.

Below, we explore some of the best and most practical methods for Cashing out small payments (소액결제 현금화) amounts while keeping extra costs minimal.

Use Peer-to-Peer Payment Apps

Apps like Venmo, PayPal, and Cash App have become ubiquitous for transferring and receiving smaller amounts of money. These platforms are perfect for cashing out smaller sums because of their convenience. Many of these apps allow instant transfers to your linked bank account for a minimal fee, and you can often avoid fees altogether by opting for the standard transfer, which typically takes one to three business days.

Another perk of these apps is their widespread use. Small businesses, freelancers, and even friends often transact on these platforms, making them a seamless way to cash out or use small amounts directly for purchases.

Leverage Prepaid Debit Cards

Prepaid debit cards are another incredible tool for small payment withdrawals. Services like PayPal’s Prepaid Mastercard or other loadable cards are often linked to your digital wallets. They allow you to spend your balance directly or withdraw cash from an ATM. Unlike a traditional bank withdrawal, prepaid cards eliminate the need for minimum withdrawal thresholds, making them ideal for accessing smaller balances conveniently.

Before committing to a prepaid card, check for associated fees such as ATM withdrawal charges or monthly maintenance costs to ensure it aligns with your cashing-out strategy.

Use Your Balance for Purchases

Rather than going through the hassle of transferring small payments to your account, consider using your balance directly for purchases. Many platforms, including PayPal and Cash App, allow you to spend your balance on e-commerce websites or send it directly to other users.

This method is particularly effective if you find that withdrawal charges are eating into your total amount. Instead of losing part of what you’ve earned or received, allocate your balance toward essential purchases, reducing unnecessary transfers entirely.

Choose Micro-Investing Platforms for Growth

If you’re receiving small amounts frequently and find yourself accumulating balances, why not put those funds toward something that grows? Micro-investing platforms like Acorns or Stash allow you to invest small sums into diversified portfolios. While this doesn’t technically “cash out” the funds immediately, it offers a productive way to use your small payments while working toward long-term financial goals.

Such platforms work seamlessly by rounding up spare change or recurring transfers to ensure your smaller amounts don’t go idle.

Digital Wallet Ecosystems

Platforms like Apple Pay, Google Pay, and Samsung Pay enable you to link your small balances with digital wallets, further integrating their utility. Instead of withdrawing amounts directly to your bank account, you can use these balances for in-person or online purchases. With the growing adoption of contactless payments, this method is particularly appealing and eliminates withdrawal fees altogether.

By tapping into these digital ecosystems, you transform your small balances into a resource for daily expenses.

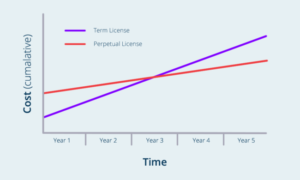

Keep an Eye on Fees and Limits

No matter which method you choose, it’s essential to stay wary of fees and restrictions. These can quickly erode the value of smaller payments if you’re not careful. Make it a habit to review the transaction fees in your chosen platform and explore if there are free transfer options or discount periods.