Fraud is on the rise globally, threatening businesses and individuals alike. According to data, global online payment fraud alone is expected to surpass $48 billion in losses in 2023. The implications of fraudulent activities can be devastating—not only financially but also in terms of trust and reputation. This is where the role of identity verification becomes indispensable.

Identity verification stands as one of the most robust tools organizations can implement to combat fraud. By ensuring that users are who they claim to be, businesses can protect themselves, their customers, and their bottom line. Below, we’ll explore the importance of identity verification in curbing fraud and supporting secure operations.

What Is Identity Verification?

Identity verification is the process of confirming that an individual’s claimed identity matches their true identity. It often involves analyzing government-issued IDs, biometric data, or other personal identifiers.

Traditionally, this was done in face-to-face interactions, like when applying for a bank account. However, as enterprises have shifted operations online, verification procedures have evolved to include advanced digital tools. Whether through facial recognition, fingerprint matching, or document scanning, these technologies make it challenging for fraudsters to assume false identities.

Why Identity Verification is Crucial in Fraud Prevention

The power of identity verification becomes evident when analyzing its impact on deterring fraud. Here are some key ways it strengthens fraud prevention efforts:

1. Stops Account Takeover (ATO) Attempts

Account takeover fraud is one of the fastest-growing tactics in cybercrime. Criminals often use stolen credentials to gain unauthorized access to user accounts, leading to both monetary and data losses. Identity verification adds an additional layer of security through methods such as multi-factor authentication or biometric verification, thereby making ATOs much more difficult to carry out.

2. Detects Synthetic Identity Fraud

Fraudsters are increasingly creating synthetic identities by combining real and fake information. For instance, they may use a stolen Social Security Number but pair it with a fictitious name and address. With AI-driven identity verification tools, organizations can analyze vast datasets and detect inconsistencies that indicate synthetic fraud.

3. Enhances KYC Compliance

Know Your Customer (KYC) requirements mandate that businesses verify the identities of their clients to prevent money laundering and other fraudulent activities. Failure to do so can result in hefty fines and a tarnished reputation. Implementing identity verification not only ensures compliance but showcases a commitment to secure, transparent operations.

4. Builds Consumer Trust

Apart from financial damages, fraud erodes customer trust. According to surveys, 81% of consumers are more likely to stay loyal to companies they deem as trustworthy stewards of their personal data. By adopting rigorous identity verification procedures, businesses make it clear that protecting their customers is a top priority.

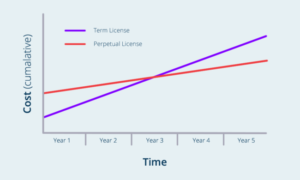

5. Reduces Operational Costs

While implementing identity verification systems comes with an upfront cost, the long-term savings are substantial. Preventing fraud reduces financial losses, legal fees, and reputational repair expenses. Additionally, automated solutions streamline verification processes, cutting down on labor costs.

Supporting Data on Identity Verification’s Impact

The effectiveness of identity verification in fraud prevention is reflected in the numbers:

- $26 billion savings: Businesses using advanced identity verification methods have collectively saved this amount in fraud losses in 2022.

- 85% fraud reduction: Companies implementing biometric verification have reported a drop in fraudulent transactions by 85%.

- 71% preference: Consumers prefer companies that offer visible security measures, reinforcing the importance of robust fraud prevention tools.

The Road Ahead

Fraud tactics continue to evolve, but so do security measures. Identity verification remains one of the most efficient tools in the fight against fraudulent activities. By leveraging cutting-edge technologies like artificial intelligence, machine learning, and biometrics, businesses can stay ahead of emerging threats while building trust with their customers.

Integrating identity verification into a fraud prevention strategy is no longer a luxury; it is a necessity. Organizations that invest in these measures today will enjoy not only reduced fraud risk but also enhanced customer loyalty and operational efficiency tomorrow.